[Editorial] Is Foreign Capital Fleeing China or Flooding In? A Deep Dive into the Two-way Flows of Global Investment

- Aries Qian

- Dec 13, 2025

- 8 min read

Updated: Dec 14, 2025

Key words: Investment | Foreign capital

In the swirling currents of global economics, few narratives have captured as much attention in 2025 as the question of foreign direct investment (FDI) in China. Headlines oscillate between alarmist tales of a mass exodus—fueled by geopolitical tensions, supply chain disruptions, and economic slowdowns—and more nuanced stories of robust inflows that underscore China's enduring appeal as a manufacturing powerhouse and innovation hub. But as we sift through the data and on-the-ground realities, a clearer picture emerges: far from a one-way flight, foreign capital is engaging in a sophisticated dance of inflows and outflows, particularly in the renewable energy sector. This dual flow not only reflects shifting global priorities but also signals profound changes in the world's political and economic landscape.

Drawing from recent analyses, including reports from the United Nations Conference on Trade and Development (UNCTAD) and McKinsey Global Institute, global FDI fell by 11% in 2024 to $1.5 trillion, yet China's story defies this downturn in key ways. While overall FDI inflows to China dipped by 13.6% in 2023 to $163.2 billion (UNCTAD World Investment Report 2024), preliminary data for 2025 shows a rebound in high-tech and green sectors, with inflows reaching approximately $120 billion in the first eight months alone, according to China's Ministry of Commerce (MOFCOM). This isn't a blanket retreat; it's a recalibration. Foreign firms aren't abandoning China—they're doubling down on strategic bets, even as Chinese companies push outward in a bid for global dominance in renewables.

For overseas decision-makers in the renewable energy industry—executives at solar panel manufacturers, battery producers, and EV assemblers—this analysis offers critical insights. We'll explore where foreign capital is coming from, which industries it's targeting, and why. We'll also examine the parallel surge of Chinese renewable energy giants expanding abroad, unpacking the reasons behind this outbound push. Finally, we'll predict future trends and dissect what this "two-way traffic" reveals about evolving global power dynamics. Backed by data from sources like the International Energy Agency (IEA), Bloomberg, and official government statistics, this piece aims to equip you with the foresight needed to navigate these waters.

The Inflow Surge: Who's Coming to China, and Why?

Contrary to the "fleeing China" trope peddled in some Western media, foreign investment is pouring into the world's second-largest economy at a pace that belies broader global slumps. In the first seven months of 2025, China saw 36,133 new foreign-invested enterprises established—a 14.1% year-on-year increase—despite a 13.4% dip in total utilized foreign capital to RMB 4,673.4 billion (MOFCOM data). The real story lies in the quality, not just the quantity: high-tech industries absorbed RMB 1,373.6 billion, with standout growth in e-commerce services (up 146.8%), aerospace equipment (up 42.2%), and medical instruments (up 25.5%).

The primary sources of this capital? Europe and Asia dominate, with Germany and Japan leading the charge, followed by Switzerland, the UK, and ASEAN nations. Germany's FDI in China hit 57 billion euros in 2023-2024, up from previous averages, accounting for over 50% of the EU's total investments in the country (German Chamber of Commerce in China). Japan's inflows surged 53.7% in the first seven months of 2025 (MOFCOM), bucking the trend amid warming bilateral ties. ASEAN investments ticked up 1.1%, while Switzerland's jumped 63.9%, reflecting a broader pivot toward China's stable supply chains amid global volatility.

Industries drawing the most interest include automotive, chemicals, high-tech manufacturing, and—crucially for our readers—renewable energy components like batteries and solar equipment. Manufacturing overall claimed RMB 1,210.4 billion in the first seven months, with services at RMB 3,362.5 billion. In renewables, foreign firms are betting big on China's ecosystem for EV batteries and solar panels, where the country holds 80% of global solar manufacturing capacity (IEA World Energy Investment 2025).

What drives this influx? At its core, it's a trifecta of market access, cost efficiencies, and innovation synergies—evolving beyond cheap labor to what experts call "system costs" and "future costs" advantages. China's manufacturing value-added now accounts for 31% of the global total, per the United Nations Industrial Development Organization (UNIDO) 2025 report, offering unparalleled supply chain integration. High energy costs in Europe (Germany's industrial electricity prices tripled post-Ukraine crisis to 0.3 euros/kWh) and regulatory hurdles like the EU's green policies have pushed firms eastward. Meanwhile, China's vast consumer market—home to over 1.4 billion people—and its lead in digital transformation provide "innovation cost" edges, shortening product development cycles by up to 30% (as seen in Volkswagen's Hefei center).

To illustrate, let's break it down by country and industry with specific examples:

Germany (Automotive and Chemicals): German firms, facing domestic bankruptcies (22,000 in 2024, up 12% in H1 2025), are relocating en masse. Volkswagen invested 25 billion euros to expand its Hefei facility, achieving 80-vehicle annual capacity with 90% local sourcing—slashing logistics costs and tapping China's EV boom. Similarly, BASF poured 87 billion euros into a Guangdong integrated site, citing China's energy stability and rare earth access (China controls 90% of global refined rare earths, per IEA). These moves aren't just cost-driven; they're strategic, embedding firms in China's innovation hubs like Jiangsu's Taicang, home to 560 German enterprises generating over 670 billion yuan in output.

Japan (Manufacturing and Automotive Parts): Amid U.S. trade pressures, Japanese investment rose 59.1% in H1 2025 (MOFCOM). Yokohama Rubber's subsidiary Yutaka Ham acquired full control of its Shandong joint venture, leveraging China's EV market for high-performance tires—aligning with its "Yokohama Transformation 2026" plan. Another: Panasonic expanded battery production in Dalian, drawn by synergies with local suppliers and a market where EVs now comprise 35% of new sales (China Association of Automobile Manufacturers, 2025 data).

EU Broadly (Renewables and High-Tech): Despite EU efforts to "de-risk" via the 3 billion euro "RESourceEU" plan (aiming to halve single-country dependency by 2029), firms like Spain's Iberdrola are investing in Chinese wind turbine joint ventures, attracted by cost advantages (Chinese turbines are 20-30% cheaper, per BloombergNEF). In batteries, Hungary's SK Innovation (South Korean but EU-based) partnered with Chinese firms for a 10 billion euro plant, navigating EU subsidies while accessing China's lithium expertise.

These inflows highlight a pragmatic calculus: over 50% of Japanese firms and 36.6% of German ones (IFO Institute survey) plan further expansions, viewing China not as a risk but as a resilience booster. As one BASF executive noted, "China's market is crucial for offsetting European capacity weaknesses" (Bloomberg, 2025).

To visualize the trends, consider this chart from China Briefing, detailing FDI inflows by sector in early 2025:

And for a broader view, Statista's monthly FDI inflows graph underscores the resilience in high-value areas:

The Outbound Push: China's Renewable Energy Giants Go Global

Even as foreign capital streams in, China's renewable energy supply chain is aggressively expanding outward—a phenomenon that's reshaping global markets. In 2025, Chinese clean-tech firms pledged over $210 billion in overseas investments since 2022 (Bloomberg data), with $180 billion targeting the Global South alone (Carbon Credits report). This isn't flight from home; it's a strategic offensive driven by overcapacity, trade barriers, and the quest for new growth frontiers.

Why the exodus? Domestically, China's solar and battery sectors face saturation: solar capacity hit 1.2 terawatts installed by mid-2025 (National Energy Administration), outpacing demand and driving prices down 40% year-on-year (BloombergNEF). Abroad, tariffs like the U.S.'s 50% on Chinese EVs (extended in 2025) and EU probes into subsidies force localization. Geopolitics plays a role too— "friendshoring" to allies like Mexico and Southeast Asia mitigates risks. Finally, proximity to markets reduces shipping costs (up 37% for China's global container share in Q1-Q3 2025, per UNCTAD) and taps local incentives, such as U.S. Inflation Reduction Act subsidies.

Leading this charge are behemoths like CATL, BYD, Trina Solar, and Longi, whose layouts span continents. Here's a snapshot:

Company | Key Overseas Layouts | Capacity/Details | Reasons |

CATL (Contemporary Amperex Technology Co. Limited) | Germany (Erfurt plant, 14 GWh/year); Hungary (Debrecen, 100 GWh by 2027); U.S. (partnership with Ford in Michigan, 35 GWh); Indonesia (joint venture with Antam, 8 GWh) | Total overseas capacity: 200 GWh by end-2025, up from 100 GWh in 2024 (company reports). | Bypass tariffs (EU anti-subsidy duties); access EU subsidies (Hungary's 7.3 billion euro aid); secure nickel supplies in Indonesia; U.S. IRA tax credits worth $7 billion. |

BYD (Build Your Dreams) | Thailand (Rayong factory, 150,000 EVs/year); Brazil (Bahia plant, 150,000 units); Hungary (Szeged, full-cycle EV assembly); Mexico (scouting for battery plant) | Overseas sales: 500,000 units in 2025, 30% of total (BYD earnings). | Counter U.S./EU tariffs (100% on Chinese EVs); tap ASEAN growth (Thailand's EV subsidies); localize for Latin America's lithium riches. |

Trina Solar | Vietnam (multiple factories, 5 GW panels/year); U.S. (Texas module plant, 5 GW); Thailand (cells and modules, 4 GW) | Global capacity outside China: 20 GW by 2025 (Trina announcements). | Diversify amid U.S. Uyghur Forced Labor Prevention Act; access low-cost labor in Southeast Asia; IRA incentives for U.S. production. |

Longi Green Energy Technology | Malaysia (Serendah wafer plant, 10 GW); India (joint venture, 1 GW modules); U.S. (Ohio assembly, 1 GW) | Overseas expansion: $2 billion invested in 2025 (Longi filings). | Mitigate trade barriers (India's 40% solar duties); secure polysilicon alternatives; build resilience against supply disruptions. |

These moves have poured $143 billion into foreign EV and battery ventures from 2014-2025 (Rest of World data), with CATL, BYD, and Gotion accounting for nearly 50% of China's domestic battery capacity now eyeing Europe and North America (Transport & Environment report). The result? Jobs in host countries (e.g., 10,000 in Hungary's Debrecen) and cheaper clean tech globally—solar costs in the Global South dropped 20% thanks to Chinese investments (Carbon Credits, 2025).

Firms like REBIO GROUP are pivotal here, having successfully assisted Chinese photovoltaic and in-vitro diagnostics (IVD) enterprises in capacity outflows—streamlining regulatory hurdles and site selections. REBIO is also gearing up to support incoming foreign firms with capacity transfers into China, bridging this two-way street.

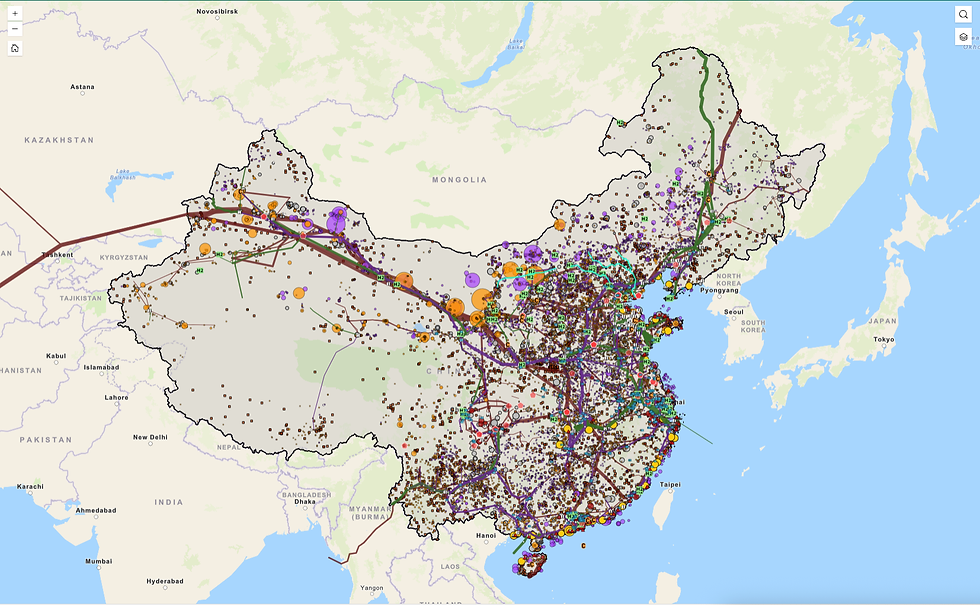

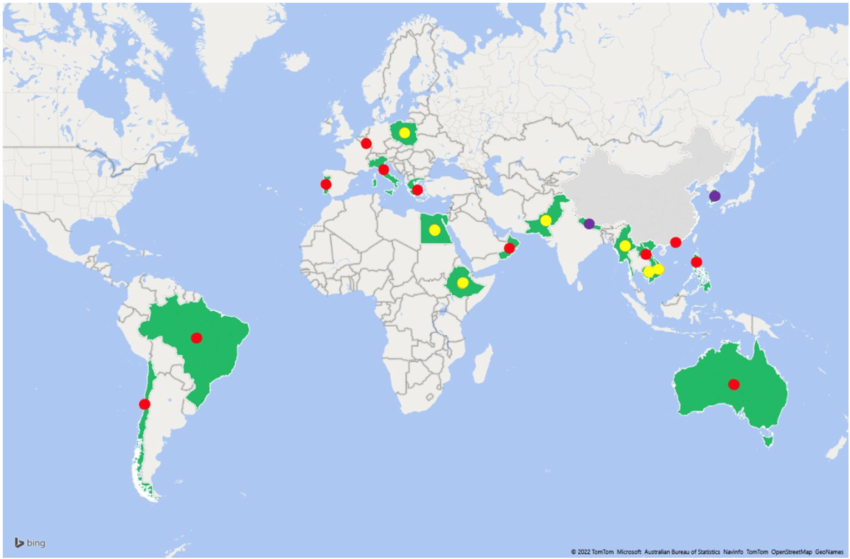

For a geographic perspective, this map from the Baker Institute highlights China's overseas energy infrastructure footprints:

And ResearchGate's grid investment map complements, showing power sector expansions:

The Bigger Picture: What Dual Flows Mean for Global Politics and Economics

This bidirectional movement—inflows bolstering China's hubs while outflows globalize its renewables—mirrors tectonic shifts in the global order. Gone is the unipolar era of U.S.-led globalization; in its place rises a multipolar landscape where supply chains are "friendshored" amid U.S.-China decoupling. UNCTAD's World Investment Report 2025 notes infrastructure FDI to developing countries fell 35%, yet China's outbound clean-tech surged 70% (Climate Energy Finance), filling voids in the Global South and reshaping alliances.

Politically, it's a tale of de-risking versus interdependence. The EU's 3 billion euro push to recycle rare earths (meeting 20% of battery demand) counters China's dominance, but as von der Leyen warned, "Europe can't keep acting as before" (EU Commission, 2025). Meanwhile, China's $1 trillion trade surplus in 2025 (MOFCOM) funds outbound plays, enhancing its soft power—e.g., $2.8 billion in overseas renewables in 2022-2023 (IRENA). This dualism exposes fractures: Western tariffs accelerate Chinese localization, but also foster tech transfers, as seen in BYD's Thai factories boosting local GDP by 2% (Thai Board of Investment estimates).

Economically, it accelerates the green transition. China's clean energy investment hit $625 billion in 2024 (IEA), driving global trends where renewables now contribute 10% to its GDP (Carbon Brief, 2025). Dual flows democratize access: African nations gain from Chinese solar dams, while Europe benefits from affordable batteries. Yet risks loom—overreliance could spark more WTO disputes (198 against China in 2025).

Looking ahead, predictions point to intensification. McKinsey forecasts FDI in semiconductors and EVs shifting geometries, with China's outflows hitting $300 billion by 2030 in greens (McKinsey FDI Shake-Up, 2025). Inflows may stabilize at $150-200 billion annually, focused on AI and renewables, per State Department 2025 Investment Climate Statements. For renewable execs, this means opportunities in joint ventures but challenges from tariffs—plan for localized production.

Ember's graph on China's transition reshaping global energy:

And Carbon Brief's solar investment chart:

Whether by coincidence or design, recent data released by China's Ministry of Commerce has dropped a bombshell on the global economic landscape: from January to November 2025, China's goods trade surplus will exceed $1 trillion, reaching a staggering $1.08 trillion. John Mearsheimer, a renowned American scholar of international relations, bluntly stated, "China has completely won; global economic power has shifted." This $1.08 trillion is no ordinary figure; it acts like a multifaceted prism, reflecting profound changes in the global economic landscape and seemingly the result of the collective efforts of global capital.

In sum, foreign capital isn't fleeing China—it's evolving with it. This two-way flow heralds a world where economic might increasingly aligns with green innovation, urging leaders to adapt or risk being left behind. As global energy investment climbs to $3.3 trillion in 2025 (IEA), China's role as both magnet and exporter will only grow, promising a more interconnected, if contested, future.

Comments