[Insight] Behind the Surge in Solar Imports in 20 African Countries: Analysis of Growth Patterns and Underlying Driving Forces

- Matthew Dung

- Nov 7, 2025

- 9 min read

Core Insights and Overview of Macro Trends

1.1 Initial Evidence of Africa's Solar Boom: A Bottom-Up Energy Revolution

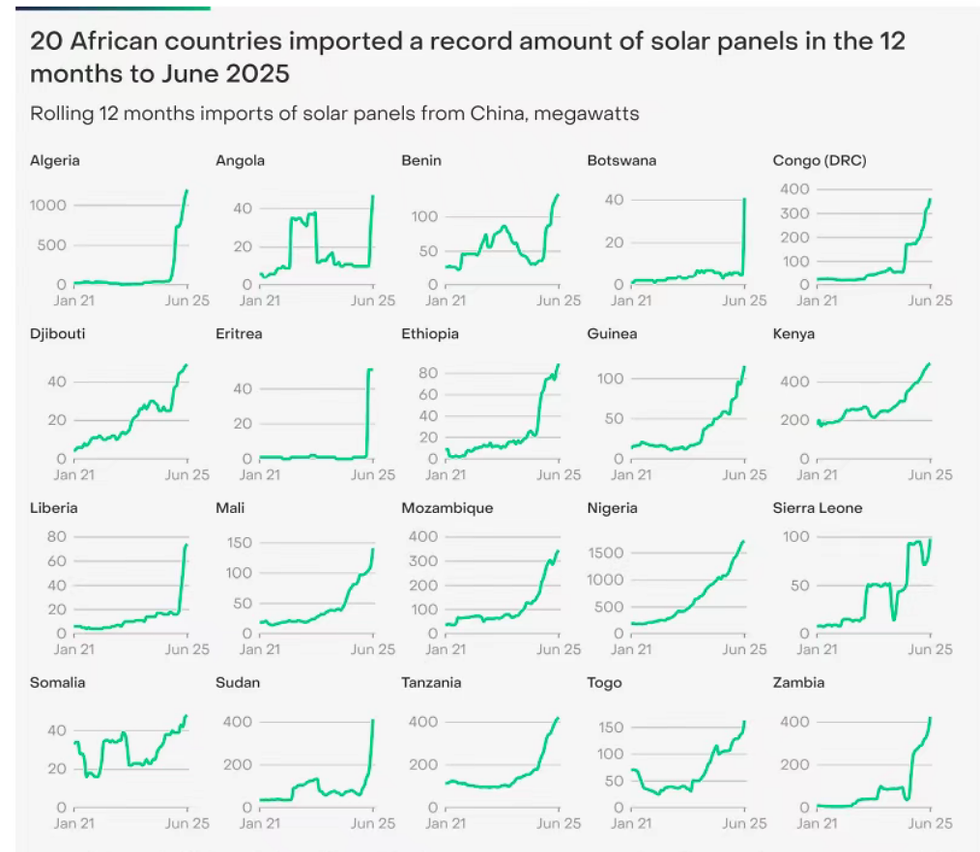

The report "First Evidence of Africa's Solar Power Boom" released by the Ember think tank reveals that the African continent is undergoing an energy transformation driven by solar power. The core finding of the report is that in the 12 months ending June 2025, Africa's imports of solar panels from China reached a record high of 15,032 megawatts (MW), a 60% surge compared to the same period last year. Over the past two years, solar panel imports in African countries excluding South Africa have nearly tripled, increasing from 3,734 MW to 11,248 MW. Preliminary analysis indicates that this growth is likely driven primarily by distributed solar rather than utility-scale solar.

The most prominent feature of this growth is its widespread geographic distribution. Unlike the import surge in South Africa in 2023 triggered by a power crisis, this growth represents a structural shift across the entire African continent. In the past 12 months, 20 African countries have set new records for solar panel imports, indicating that the scaling of solar applications is occurring broadly. Additionally, the number of countries importing more than 100 MW has increased from 15 last year to 25, further confirming the trend of geographic diffusion in solar deployment. For example, in Sierra Leone alone, the solar panels imported in the past 12 months, if fully installed, would generate enough power to meet 61% of the country's total electricity generation in 2023.

1.2 Economic Drivers: Cost-Effectiveness and Diesel Substitution

The rapid growth of solar in Africa is not accidental; its underlying drivers are a combination of global photovoltaic market dynamics and local economic demands in Africa. As the producer of 80% of the world's solar panels, China's expanded capacity and continuously declining prices have enabled solar technology to enter the African market at unprecedented low costs.

African countries have long faced challenges such as underdeveloped grid infrastructure, unstable power supply, and high energy costs. Businesses and households have had to rely on expensive and polluting diesel generators to ensure basic electricity, which not only increases operational costs but also exacerbates dependence on imported fuels. In this context, the rise of solar is no longer just for achieving "environmental" goals but a more economically viable "self-rescue" solution. Taking Nigeria as an example, the cost of a solar panel is only about $60, and the savings from substituting diesel can recoup the investment in just six months. This direct and quantifiable economic return has transformed solar from a national macro-level energy transition issue into an essential for survival and development at the micro-level for businesses and households. This "bottom-up" growth model, driven by market demand and economic rationality, injects strong internal momentum and resilience into Africa's energy transition.

In-Depth Reasons for Growth in 20 Countries and Specific Case Studies

After a detailed analysis of Africa's solar growth, it can be found that the driving factors behind it are diverse and tailored to local conditions. Overall, these factors mainly include: ambitious national policies, responses to severe energy crises, utilization of abundant natural resources, innovative business models, and solid international cooperation.

2.1 Detailed Analysis of Country Cases

2.1.1 Policy and Macro Strategy-Driven: Algeria

Algeria is a typical case of solar growth driven by national macro strategies. In the past 12 months, its solar panel imports surged 33-fold, catapulting it to become Africa's third-largest solar panel importer. This extraordinary growth is not merely spontaneously formed by market demand but a direct manifestation of the country's ambitious energy transition plan aimed at reducing heavy dependence on oil and gas exports.

The Algerian government has set an ambitious goal of renewable energy accounting for 27% of the national total electricity generation by 2030. To achieve this, the government has launched a series of large-scale solar project tenders, such as the highly anticipated "Solar 1000 MW" and 2 GW projects.

These initiatives aim to expand solar deployment from remote rural areas to the national grid. More importantly, Algeria's energy transition is not just about simple equipment imports but a national-level industrial upgrade. Through strategic cooperation with global leading companies like China's LONGi Green Energy, the country plans to establish a solar panel manufacturing plant with an annual capacity of 1 gigawatt (GW) domestically. This move will not only meet growing domestic demand and reduce dependence on imports but also aims to create hundreds of local jobs and ultimately position Algeria as a solar technology production and export hub in North Africa. Additionally, the government has abolished the "49/51" rule restricting foreign ownership, providing a more favorable legal and policy environment for international investment, which has greatly accelerated project implementation.

2.1.2 Energy Crisis and Grid Challenges-Driven: Nigeria, Zambia, Democratic Republic of the Congo (DRC)

The solar growth in these countries is primarily driven by long-standing energy supply shortages and grid instability.

Nigeria: As Africa's most populous country, Nigeria has long been plagued by severe power crises, with over 100 million people lacking reliable electricity supply. Its outdated and unreliable transmission and distribution network is the main bottleneck. Therefore, Nigeria's solar boom is mainly reflected in the vigorous development of distributed and mini-grid solutions. These solutions bypass the unreliable national grid, directly providing stable and affordable electricity to households, businesses, and industries, effectively addressing the energy crisis. The country has become Africa's largest off-grid solar market.

Zambia: Zambia's solar imports grew eightfold in the past year, driven by an energy security crisis triggered by climate change. Over 80% of the country's electricity supply relies on hydropower. However, sustained severe droughts in recent years have caused major reservoirs (such as Lake Kariba) to drop to historic lows, significantly reducing hydropower capacity and leading to prolonged nationwide blackouts. This predicament has prompted the Zambian government and businesses to accelerate solar deployment to diversify the energy structure and reduce vulnerability to a single energy source.

Democratic Republic of the Congo (DRC): Although the DRC has enormous hydropower potential exceeding 100 gigawatts (GW), its national electrification rate is only 15%. This highlights the challenges of long construction cycles and huge funding requirements for large infrastructure projects. Due to extremely low grid coverage, off-grid solar systems have become a fast and flexible solution to provide electricity to remote areas and meet the demands of high-energy-consuming industries like mining. The country's threefold increase in imports reflects the market's pursuit of more direct paths through solar technology to address power shortages.

2.1.3 International Aid and Innovative Models-Driven: Liberia, Sierra Leone, Togo, Benin, Mali, Somalia, Eritrea, Djibouti

These countries generally face severe energy poverty but are achieving rapid electrification through international aid and innovative business models.

Common Pathways: Funding support from institutions like the World Bank's "Mission 300" plan and the African Development Bank, as well as the proliferation of business models such as "pay-as-you-go" (PAYG) and mini-grids, enable these countries to bypass the limitations of traditional grid infrastructure. For example, in Benin, the European Investment Bank, in collaboration with Engie Energy Access, provides solar home systems to 107,000 households through PAYG contracts. The Togolese government has launched the CIZO project, using geospatial modeling and digital tools to promote the adoption of solar home systems through monthly subsidies.

Key Projects: In Somalia, Eritrea, and Djibouti, specific international aid projects are being translated into actual power infrastructure. In Somalia, the African Development Bank-funded 12 MW solar-plus-storage power plant project is underway, aiming to enhance its energy security and stability. In Eritrea, the African Development Fund-funded 30 MW Dekemhare solar project will effectively reduce the country's dependence on expensive imported fossil fuels.

2.1.4 Emerging Markets and Diversification-Driven: Kenya, Angola, Botswana, Sudan, Ethiopia, Guinea, Mozambique

These countries play roles as emerging markets in their respective regions, with their solar development showing diversified characteristics.

Kenya: Kenya is the largest solar importer in East Africa. Over 20% of the country's rapid electrification rate is attributed to off-grid solar solutions. Kenya's solar market is expanding from being a leader in off-grid to broader areas such as large-scale projects and agricultural applications.

Angola: Angola's solar imports more than tripled in the past year. The country is ambitiously implementing a plan to add 800 MW of solar capacity by 2025. These projects aim to reduce dependence on hydropower and attract private sector investment by providing comprehensive technical and financial assessments.

Guinea: Despite Guinea's enormous hydropower potential, its state-owned power company has long faced financial difficulties. Therefore, the government is building solar power plants to reduce dependence on electricity imports from neighboring countries, thereby enhancing national energy autonomy and self-sufficiency.

Country | 12-Month Import Growth (Fold) | Key Drivers | Major Projects/Policies | Future Outlook/Challenges |

Algeria | 33x | National strategy, industrial upgrade | "Solar 1000 MW" tender, LONGi factory partnership | North Africa export hub; attract ongoing FDI |

Nigeria | - | Power crisis, grid issues | Nigeria Electrification Project, off-grid/mini-grids | Financing hurdles, tariff stability; expand reach |

Zambia | 8x | Hydro dependence, climate risks | Eighth National Development Plan, diversification | Mitigate drought impacts; build resilience |

Botswana | 7x | Diversification, private funds | PV industry investments, large projects | Early stage; bolster policies and investments |

Sudan | 6x | Shortages, off-grid needs | Imports to combat blackouts | Political instability may stall deployments |

Liberia | 3x+ | Aid, off-grid models | World Bank rural renewables | Grid upgrades; convert imports to output |

DRC | 3x+ | Grid gaps, mining demands | Regional interconnects, solar for remotes | Political/financing risks; regulatory improvements |

Benin | 3x+ | Aid, PAYG | EIB-Engie home systems | Policy execution; scale projects |

Angola | 3x+ | Diversification, investments | 800 MW by 2025, utility-scale | Less hydro reliance; global capital influx |

Ethiopia | 3x+ | Rural access, hydro complement | National Electrification Plan, Solar Alliance | Balance solar with mega-hydro |

Guinea | 3x+ | Import reduction, infrastructure | First grid-connected PV plant | Utility finances; network strengthening |

Kenya | - | Rural electrification, off-grid lead | Widespread home/mini-grids | Shift to utility/agri applications |

Tanzania | - | Shortages, single-source risks | Diversify from gas/hydro | Boost low-carbon share; infrastructure growth |

Mozambique | - | Off-grid growth, universal access | 2030 goal: 80% grid + 20% off-grid | Interconnect grids; address aging assets |

Somalia | - | Aid, rebuilding | AfDB 12 MW solar-storage | Grid reliability; private funding gaps |

Eritrea | - | Fossil reduction, cooperation | AfDF 30 MW Dekemhare | Energy security; sustained aid/tech |

Djibouti | - | Access goals, aid | World Bank sustainable electrification | Rural coverage; private involvement |

Mali | - | Rural, off-grid | Green Climate Fund mini-grids | Local ops training; financing |

Togo | - | PAYG, subsidies | CIZO home systems | Fiscal backing; nationwide rollout |

Sierra Leone | - | Off-grid, aid | Rural renewables projects | Imports to generation; network bolstering |

Table 1: Overview of Growth Drivers and Future Potential in 20 Major African Solar Importing Countries

For some countries (such as Botswana, Sudan, Tanzania, Mozambique), the import data growth rates were not explicitly provided in the original report, but it was clearly mentioned that the growth rates were high or set new records, so they are marked as "high multiples" or "-" in the table.

Future Outlook, Challenges, and Strategic Recommendations

3.1 Core Challenges and Risks

Although the African solar market shows astonishing growth potential, its future development still faces multiple challenges, with the most critical being financing bottlenecks. Currently, the capital costs for clean energy projects in Africa are 3 to 7 times higher than in developed countries. Although clean energy investment doubled to $40 billion in 2024, it still falls far short of the $200 billion needed annually to achieve universal access and climate goals.

Additionally, policy and regulatory uncertainties are major concerns for investors. Many countries' regulatory environments lack specific and reliable information, and sustainable business models have not been fully established. For example, although Benin has established a regulatory framework favorable to private sector investment, it still encountered delays and challenges in the first implementation. This indicates that translating policy intentions into predictable and investment-friendly business environments still requires time.

Another important challenge lies in infrastructure limitations. While underdeveloped grids are the driving force behind the rise of distributed solar, they also pose obstacles to large-scale grid integration and absorption of solar. The influx of large quantities of solar panels requires stable grids to support them, but many countries' grid systems are not yet prepared for this.

The key information gap from "import boom" to "installation dilemma" also deserves attention. Customs import data, as a leading indicator, reflects the market's enormous demand and potential, but there is a significant time lag and information blind spot between it and actual installation and operation data. As seen in Pakistan's experience, imported solar panels may remain unused due to grid connection difficulties, stay in warehouses for long periods, or even be resold to neighboring countries. This data disconnect poses a major risk to Africa's energy transition: governments cannot accurately assess the actual scale of distributed generation, thereby missing opportunities to plan grid capacity, integrate energy storage systems, and other key technologies. Therefore, establishing timely and accurate mechanisms for tracking installation and operation data is key to ensuring an orderly, fair, and inclusive solar transition in Africa.

3.2 Strategic Opportunities and Development Expectations

In the face of challenges, the future of solar in Africa remains full of hope. First, innovative business models such as "pay-as-you-go" (PAYG) and mini-grids are continuously proving their feasibility. These models not only address initial payment barriers for rural and low-income populations but also directly promote local economic activities and improve quality of life by providing reliable electricity.

Second, localized manufacturing and capacity building are becoming important strategies for African countries. Countries like Algeria have recognized that relying solely on imports poses trade deficits and supply chain risks. By establishing local manufacturing plants with international partners, jobs can be created, local technology developed, and energy independence enhanced. At the same time, strengthening training and capacity building for technical personnel is the cornerstone for ensuring the long-term sustainable operation of solar systems.

Finally, international cooperation will continue to be the core driving force for Africa's solar development. The "Mission 300" plan jointly launched by the World Bank and the African Development Bank aims to provide electricity to 300 million people in Africa by 2030. Meanwhile, the continued participation of Chinese companies in Africa, especially in engineering, procurement, and construction (EPC), funding, and technology transfer, will be the core force helping Africa overcome financing and technical barriers and realize its enormous solar potential.

For cutting-edge solar solutions that empower distributed energy systems across Africa and beyond, discover Kada Energy's customized offerings at kada-tech.com.

![[Insight] Q3 Central and Eastern Europe Commercial Battery Storage: Poland Reigns as Revenue Powerhouse](https://static.wixstatic.com/media/353844_035d6f77835a49708452be9bcb6d5ac8~mv2.png/v1/fill/w_980,h_427,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/353844_035d6f77835a49708452be9bcb6d5ac8~mv2.png)

Comments