[Insight] The ALICE Threshold: America's Quiet Economic Divide Under SaaS Society

- Robert Cai

- Dec 27, 2025

- 7 min read

Updated: 5 days ago

In the landscape of American economic policy, few metrics capture the subtle strains on working households quite like the ALICE threshold. Coined by the United Way, ALICE stands for Asset Limited, Income Constrained, Employed—a designation for families who earn above the federal poverty line but still struggle to afford essentials such as housing, child care, food, transportation, health care, and taxes. This threshold, tailored to local costs of living, highlights a segment of the population often overlooked in traditional poverty statistics, representing those who are one unexpected expense away from financial instability. The concept emerged from collaborative research efforts in the early 2010s, initially piloted in states like New Jersey, and has since expanded nationwide through United For ALICE, providing county-level budgets that reflect real-world survival needs rather than outdated federal benchmarks.

Recent online discussions have brought renewed attention to this framework, particularly in the wake of a viral YouTube clip that dramatized the precariousness of middle-class life. The video, which surfaced in late 2025, depicted a former high-earning tech professional's rapid descent from a stable income to homelessness, framing it as a "kill line"—a point of no return where systemic pressures accelerate downfall. This narrative, amplified through social media and blogs like a Medium post titled "Behind the Alice Threshold: Invisible Boundaries of Fault Tolerance in American Society," has sparked debates on societal resilience. The post argues that the ALICE threshold acts as an invisible fault line, where minor setbacks—such as a medical bill or job loss—can trigger cascading failures due to high fixed costs and limited safety nets, leading to outcomes like eviction or credit ruin. Such discussions underscore how digital storytelling can elevate policy concepts into broader cultural conversations, prompting questions about whether current economic structures adequately buffer against volatility.

One perspective gaining traction in these talks suggests that the prominence of the ALICE threshold in the U.S. may stem from society's evolution into something akin to a vast Software-as-a-Service (SaaS) platform. As explored in the aforementioned YouTube analysis, this model reimagines citizenship as "usership," where access to basic necessities is subscription-based rather than inherent, and traditional assets give way to ongoing payments. In this view, individuals are treated as users in a system optimized for efficiency, with little tolerance for disruptions—much like how a SaaS provider might "cancel" non-paying accounts. This analogy invites exploration of how such dynamics exacerbate financial fragility for those hovering near the ALICE line.

Consider housing, for instance. In the U.S., homeownership has increasingly shifted toward rental models dominated by algorithmic pricing tools, where platforms like RealPage coordinate rent increases across markets, sometimes inflating costs by up to 25%. This creates a subscription-like obligation, with median home purchase thresholds requiring 5.1 years of income nationally—and as high as 12.5 years in areas like Los Angeles—forcing many into perpetual tenancy. A missed payment can cascade into eviction, disrupting employment and credit, aligning with ALICE vulnerabilities where housing often consumes over 30% of budgets in high-cost counties.

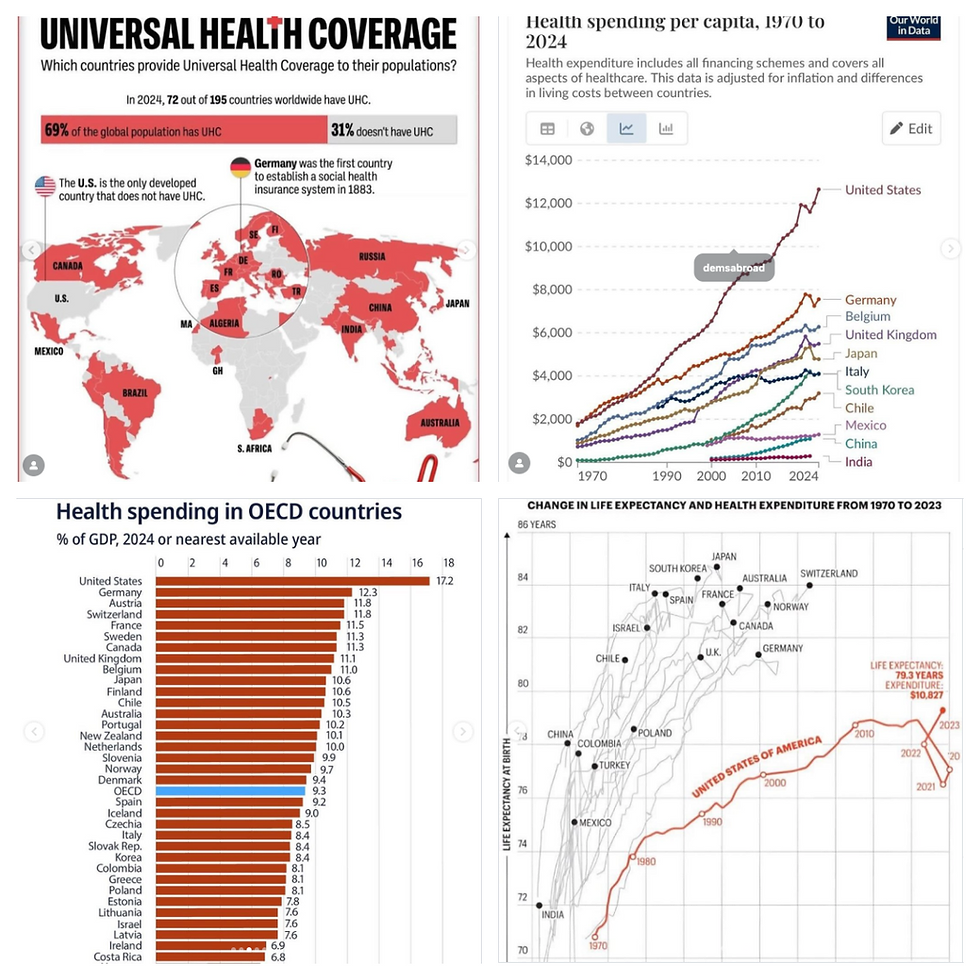

Similarly, healthcare operates on a pay-to-access basis, with high deductibles and out-of-pocket maximums functioning like premium subscriptions. Even insured individuals face annual premiums exceeding $25,000 for family coverage, plus deductibles averaging $5,000, which can deter routine care and amplify emergencies. This setup contrasts with asset-based security, as medical debt—affecting 36% of insured adults—can lead to "medical impoverishment," where a single event pushes households below the ALICE threshold.

In the gig economy, workers resemble independent contractors in a SaaS ecosystem, with platforms like Uber or Amazon imposing algorithmic oversight without benefits. High turnover rates, such as Amazon's 150%, treat employees as replaceable "batteries," where a vehicle breakdown or repair cost of $800 can interrupt income flows, leading to defaults and further exclusion. These examples illustrate how subscription-oriented systems might reduce margins for error, potentially explaining why ALICE households, comprising employed yet constrained workers, face heightened risks in an environment prioritizing seamless cash flows over human redundancy.

Turning to the demographics, the distribution of households near or below the ALICE threshold varies significantly across states, reflecting regional economic disparities and cost-of-living differences. According to United For ALICE's 2025 national report, drawing from 2023 data, 42% of U.S. households—approximately 55.5 million—fall below this threshold, a figure that includes both poverty-level and ALICE families. State-level breakdowns reveal stark contrasts: In Florida, 46% of households are below the line (13% in poverty, 33% ALICE); Michigan reports 41%, with notable racial gaps—62% of Black households and 44% of Hispanic ones affected compared to 38% of White households. Connecticut and Wisconsin follow at 40% and 35%, respectively, while New Jersey's official poverty rate is 10%, though ALICE-inclusive figures push it higher.

To visualize these variations, consider the following bar chart based on United For ALICE data, showing percentages below the threshold in selected states for 2023:

Industry-wise, the threshold intersects with occupational realities. Of the 20 most common U.S. occupations in 2023, 11 paid less than $20 per hour, with variations by state—ranging from four to more in low-wage sectors like retail, hospitality, and cleaning. In the nonprofit sector, 42% of workers' households are below the ALICE line, per a 2024 Independent Sector analysis, highlighting how even mission-driven fields struggle with compensation adequacy. Janitors and cleaners face rates as high as 54%, while overall, 23% of workers in common jobs live below the threshold.

The COVID-19 pandemic has notably altered these patterns, amplifying financial hardship. Pre-pandemic, in 2019, 50.4 million households were below the ALICE threshold; by 2023, this rose to 55.5 million, driven by rising costs, job disruptions, and increased debt loads. Surveys from United Way during the crisis indicated that 70% of ALICE households experienced employment changes, such as layoffs or reduced hours, exacerbating vulnerabilities. Post-pandemic reports, like those for Wisconsin and Florida, show household essentials costs surging, with ALICE proportions climbing in states like Ingham County, Michigan, from pre-crisis levels.

This evolution draws attention to underlying factors that can tip ALICE households into crisis, with medical costs emerging as a pivotal element. As noted in the Medium analysis, the U.S. system's lack of universal coverage—leaving 27.2 million uninsured—means even minor health events can deplete savings, leading to eviction or homelessness. Federal Reserve data reinforces this, showing 37% of adults unable to cover a $400 emergency, often medical in nature.

Comparing U.S. and Chinese healthcare systems reveals fundamental divergences that might inform policy considerations. At the policy level, the U.S. relies on a market-driven, employer-linked insurance model with private providers dominating, resulting in fragmented coverage and high administrative costs—around 34% of total spending. China, conversely, emphasizes public provision through a tiered system with universal basic medical insurance covering over 95% of the population, subsidized by government and focused on affordability. Execution-wise, U.S. care involves complex billing and prior authorizations, often leading to "surprise bills," while China's centralized approach prioritizes preventive services and lower out-of-pocket caps, with hospitals largely state-owned for efficiency.

These differences manifest in cost disparities, even factoring in travel. For knee replacement surgery, U.S. costs range from $35,000 to $50,000, while in China, they fall between $8,000 and $20,000; adding round-trip flights from the U.S. (around $1,500-$2,500) and accommodations ($1,000 for a 10-day stay) still yields savings of 50-70%. Hip replacements follow suit: $40,000 in the U.S. versus $8,000-$15,000 in China, with net savings post-travel. For cancer treatments like CAR-T therapy for diffuse large B-cell lymphoma (DLBCL), U.S. prices near $500,000 contrast with China's $55,000, where even with $3,000 in travel expenses, the value proposition remains compelling. Routine procedures, such as cardiac bypass ($70,000-$200,000 U.S. vs. $10,000-$20,000 China) or chemotherapy cycles ($10,000+ per session U.S. vs. $2,000-$5,000 China), further highlight this, with travel-inclusive totals often undercutting domestic options by 60-80%. Dental implants, at $3,000-$5,000 per tooth in the U.S. compared to $500-$1,500 in China, round out examples where cross-border access could alleviate ALICE pressures.

Amid these challenges, innovative solutions like cross-border healthcare are emerging as potential bridges. Since early 2025, REBIO GROUP has launched its Cross-Border Healthcare service, designed to connect patients near the ALICE threshold with efficient, low-cost care in China. This initiative unfolds in two phases: first, remote consultations via telemedicine for initial assessments and planning; second, cross-border treatment involving travel for procedures, supported by logistics like airport transfers and health record management. One middle-aged man from a South Asian country requiring knee joint replacement, unavailable locally. Through REBIO GROUP, he underwent surgery in China, recovering to walk independently within 10 days, at costs far below regional alternatives. Another featured an elderly man from North Africa with DLBCL, who accessed CAR-T therapy in China at 1/3 the European price, completing treatment efficiently with comprehensive follow-up.

Just as I was finishing this article, my nephew, who is studying sociology in Europe, called to wish me a Merry Christmas. During our conversation, he also expressed his surprise at the increasing number of homeless people in the United States. Not only had he never seen homeless people in China since he was born, but he also found it even more incomprehensible that this phenomenon was escalating in the US. His research found that the lower limit of survival for ordinary people in China is very high, while the lower limit for survival for ordinary people in the US is very low.

While the number of homeless people in a country does not fully reflect its economic situation, it is undeniable that against the backdrop of a global economic downturn, regardless of whether a country is socialist or capitalist, a more inclusive and universally beneficial economic model should receive wider public support and priority.

In fact, as two superpowers, both China and the United States are essentially "centrifuges." The United States is a "capital centrifuge," throwing inefficient individuals out of the barrel, resulting in physical abandonment, while China is a "competition centrifuge," sticking inefficient individuals to the inner wall of the barrel, resulting in implicit dissipation. Furthermore, the underlying codes of China and the United States are different. The United States has "forced consumption," which leads to debt traps, while China has "forced production," which leads to locked-in responsibilities.

The resurgence of discussions on the ALICE Threshold by the end of 2025 may not be accidental; it reflects a global trend: people in countries like the US and China are increasingly valuing the cost of living and future certainty. As policymakers weigh various interventions (from wage adjustments to expanding social security), they should also delve into how the economic system can be made more resilient to ensure that working families are no longer in a state of perpetual hardship.

With the New Year approaching, let's put aside these unsettling topics for now, since we may still have a chance to make tomorrow better than today, even if it's just a little bit better. I sincerely wish every reader and REBIO’s partner a better year than this one.

Comments